In a strategic initiative to bolster financial security for its citizens, the Government of Nagaland has teamed up with Tata AIA Life Insurance to launch the Chief Minister’s Universal Life Insurance Scheme (CMULIS). This groundbreaking scheme provides life insurance coverage of INR 2 lakh to primary earning members aged 18 to 60, with a special emphasis on supporting those in unorganized sectors and low-income groups.

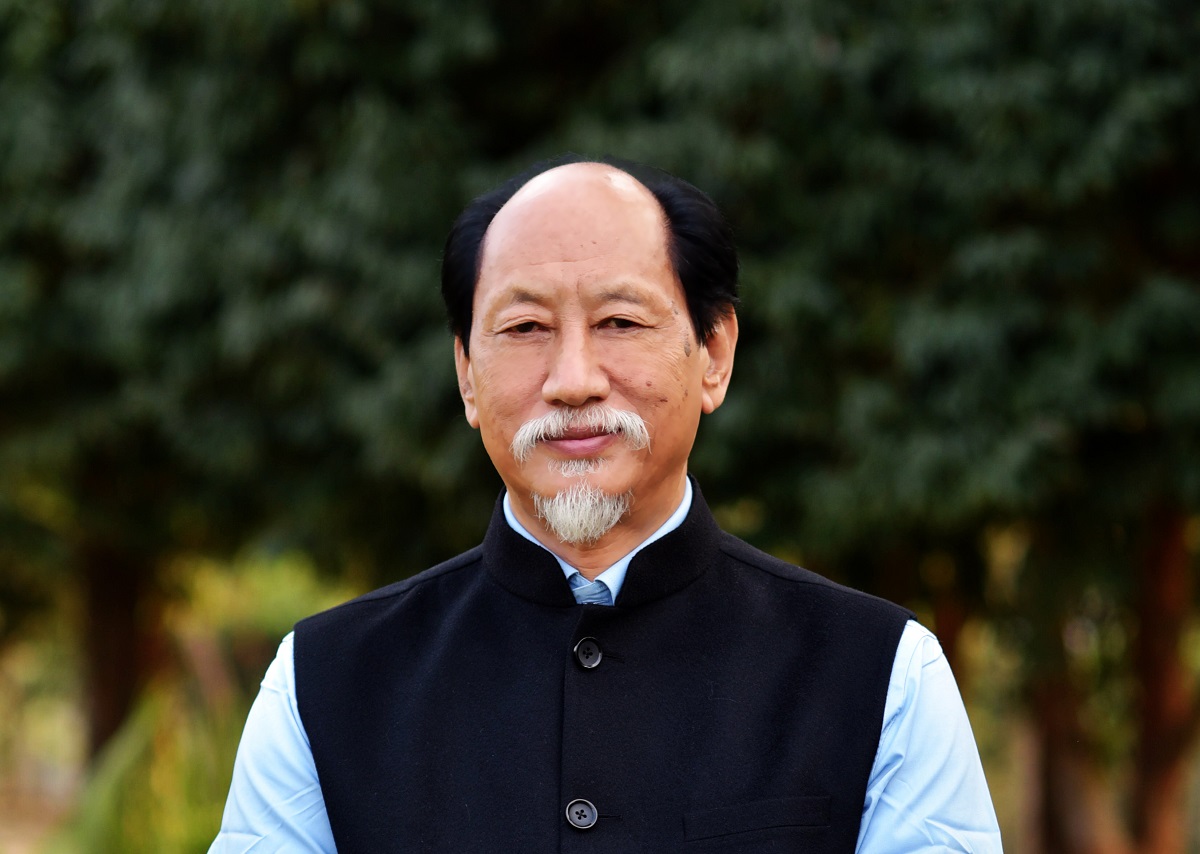

Chief Minister Neiphiu Rio stated, “I am extremely happy to partner with Tata AIA Life Insurance and launch this scheme for the working population of Nagaland. We hope to enroll all earning individuals in Nagaland under this scheme, thereby ensuring the financial security of several families.” The state government will cover the insurance premiums, making the program accessible to all eligible residents.

In Gangtok, the introduction of CMULIS is anticipated to positively influence consumer behavior. As families secure life insurance, their enhanced financial security will likely lead to increased spending on financial products and services. This boost in consumer confidence can stimulate growth in the local economy, encouraging banks and financial institutions in Gangtok to develop tailored offerings that cater to the needs of newly insured families, ultimately fostering a more robust financial ecosystem in the region.